LIC Jeevan Labh Calculator

Related Post

Introduction to LIC Jeevan Labh Policy

The LIC Jeevan Labh is a popular limited premium payment, non-linked, with-profits endowment plan from Life Insurance Corporation of India (LIC). It offers a combination of life cover, savings, and guaranteed returns, making it an attractive investment option for individuals seeking financial security and wealth creation.

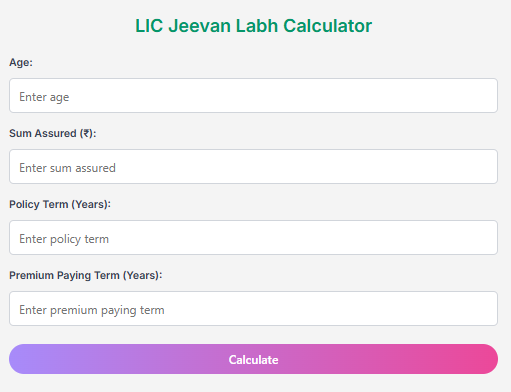

To help policyholders and prospective buyers make informed decisions, we’ve developed the LIC Jeevan Labh Calculator—a powerful, user-friendly tool that provides instant premium and maturity benefit estimates based on your inputs.

Why Use the LIC Jeevan Labh Calculator?

Manually calculating premiums and maturity benefits can be complex due to bonus rates, policy terms, and sum assured variations. Our calculator simplifies this process by:

✔ Providing quick estimates of annual premiums and maturity amounts

✔ Helping compare different policy terms (16, 21, or 25 years)

✔ Allowing “what-if” scenarios to adjust sum assured and premium payment terms

✔ Ensuring transparency in financial planning

Whether you’re a first-time buyer or an existing policyholder, this tool helps you optimize your investment under the Jeevan Labh plan.

How Does the LIC Jeevan Labh Calculator Work?

Our calculator follows LIC’s official premium calculation methodology, incorporating:

1. Key Input Parameters

- Age (Entry age: 8 to 59 years)

- Sum Assured (Minimum ₹2,00,000)

- Policy Term (16, 21, or 25 years)

- Premium Paying Term (10, 15, or 16 years)

2. Automatic Premium Calculation

The tool computes annual premiums based on:

- LIC’s premium rates (adjusted for age and term)

- Bonus additions (declared annually by LIC)

- Final Additional Bonus (paid at maturity)

3. Maturity Benefit Estimation

The estimated maturity amount includes:

✅ Basic Sum Assured

✅ Accrued Bonuses (Simple Reversionary Bonuses)

✅ Final Additional Bonus

Key Features of Our LIC Jeevan Labh Calculator

🔹 User-Friendly Interface – Simple, intuitive design for hassle-free calculations.

🔹 Accurate Estimates – Based on LIC’s latest bonus rates and premium tables.

🔹 Instant Results – No waiting; get premium and maturity values in seconds.

🔹 Mobile-Optimized – Works seamlessly on smartphones, tablets, and desktops.

🔹 No Registration Needed – Use it freely without signing up.

🔹 Financial Planning Aid – Helps you choose the best term and sum assured.

Who Should Use This Calculator?

1. Potential Policyholders

- Compare premium costs for different entry ages.

- Evaluate maturity benefits before purchasing.

2. Existing Policyholders

- Project future returns based on current bonuses.

- Assess if additional coverage is needed.

3. Financial Advisors

- Provide clients with quick, reliable estimates.

- Assist in retirement or child education planning.

4. Tax Planners

- Check tax benefits under Section 80C (premiums) and Section 10(10D) (maturity proceeds).

How to Maximize Benefits from LIC Jeevan Labh?

To get the best returns from your policy:

1. Choose the Right Term

- Longer terms (25 years) generally yield higher bonuses.

- Shorter premium payment terms (10 years) reduce financial burden.

2. Opt for Higher Sum Assured

- Larger policies attract higher bonuses.

- Ensures better financial security for dependents.

3. Start Early

- Lower premiums for younger entrants.

- Longer bonus accumulation period.

4. Pay Premiums Annually

- Saves money compared to monthly payments.

Why Trust Our Calculator?

Unlike generic financial tools, our LIC Jeevan Labh Calculator is specifically designed for this policy, ensuring:

✅ Alignment with LIC’s Latest Bonus Rates – Regularly updated for accuracy.

✅ No Misleading Projections – Clear disclaimer on illustrative calculations.

✅ Privacy Assurance – No data storage or selling of user inputs.

Frequently Asked Questions (FAQs)

Q1: Is the LIC Jeevan Labh Calculator free to use?

Yes! Our tool is completely free with no hidden charges.

Q2: Does LIC offer online premium calculators?

LIC provides basic calculators, but ours offers enhanced features like bonus-adjusted maturity estimates.

Q3: Are the maturity amounts guaranteed?

Maturity benefits depend on future bonus declarations, but our calculator uses current bonus rates for realistic projections.

Q4: Can I change my premium paying term later?

No, the premium term is fixed at policy inception.

Q5: What tax benefits apply?

- Premiums: Deductible under Section 80C (up to ₹1.5 lakh/year).

- Maturity Amount: Tax-free under Section 10(10D) if conditions apply.

Final Thoughts

The LIC Jeevan Labh Calculator empowers you to plan your investments wisely by providing transparent, instant estimates of premiums and maturity benefits. By understanding these figures beforehand, you can:

- Select the optimal policy term

- Budget for premium payments

- Set realistic financial goals