XIRR Calculator

XIRR Calculator Formula

| = | Net Present Value | |

| = | total number of periods | |

| = | non-negative integer | |

| = | cash flow | |

| = | internal rate of return |

Related Post

Table of Contents

Online XIRR Calculator | Simple, secure & free

The XIRR (Extended Internal Rate of Return) Calculator is a sophisticated financial tool designed to calculate the annualized return on investments with irregular cash flows. Unlike regular IRR calculations that assume periodic cash flows, XIRR accounts for actual transaction dates, making it essential for accurate performance measurement of real-world investments.

Key Features:

- Dynamic Transaction Management: Add/remove unlimited cash flows

- Date-Aware Calculations: Handles irregular time intervals between transactions

- Precision Engineering: Implements Newton-Raphson method for accurate results

- Input Validation: Checks for valid transactions and cash flow requirements

- Responsive Design: Works seamlessly across devices

- Instant Results: Calculates complex XIRR in milliseconds

- Error Handling: Provides clear feedback for invalid inputs

Technical Implementation:

The calculator uses three core technologies:

- HTML for structure

- CSS for modern responsive design

- JavaScript for calculation logic and dynamic UI

The XIRR calculation employs the Newton-Raphson numerical method to solve the equation:

Σ [CashFlow / (1 + rate)^((Date – FirstDate)/365)] = 0

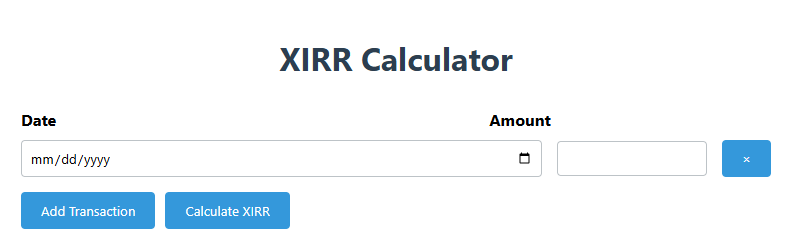

User Interface:

- Clean table-like structure for cash flow entries

- Intuitive date picker and numeric inputs

- Clear add/remove transaction buttons

- Visual feedback with color-coded results

- Mobile-optimized layout

Financial Significance:

XIRR is crucial for:

- Evaluating investment portfolio performance

- Comparing different investment opportunities

- Calculating venture capital returns

- Assessing real estate investments

- Analyzing business project profitability

Key Advantages:

- Handles real-world irregular cash flows

- Provides annualized return percentage

- Accounts for time value of money

- Enables apples-to-apples comparison of investments

- Supports both positive (inflows) and negative (outflows) amounts

Validation & Error Prevention:

- Minimum 2 transactions required

- Need both positive and negative cash flows

- Date format validation

- Numeric amount validation

- Convergence checking for calculations

Use Cases:

- Personal investment tracking

- Private equity performance measurement

- Mutual fund return calculation

- Real estate investment analysis

- Business project evaluation

- Retirement planning scenarios

Technical Considerations:

- Dates converted to day differences from first transaction

- Annualization using 365-day year convention

- Numerical stability through convergence tolerance (1e-6)

- Iteration limit (100) to prevent infinite loops

- Sorting transactions chronologically for calculation stability

Performance Optimization:

- Efficient Newton-Raphson implementation

- Pre-calculation sorting

- Vectorized cash flow processing

- Minimal DOM manipulation

Accessibility Features:

- Semantic HTML structure

- Clear visual hierarchy

- Responsive input sizing

- High contrast colors

- Keyboard-navigable controls

Comparison to Alternatives:

- More accurate than simple ROI calculations

- More flexible than regular IRR

- More practical than time-weighted returns for personal investments

- More accessible than spreadsheet solutions

Educational Value:

- Demonstrates time value of money concepts

- Illustrates compounding effects

- Helps understand cash flow timing impact

- Teaches about annualized returns

- Shows importance of accurate record-keeping

Potential Enhancements:

- CSV import/export functionality

- Graphical cash flow visualization

- Multiple scenario comparison

- Sensitivity analysis

- PDF report generation

- Cloud storage integration

- Currency support

Professional Applications:

- Financial advisors analyzing client portfolios

- Fund managers reporting performance

- Entrepreneurs evaluating business opportunities

- Accountants assessing project viability

- Individual investors tracking personal wealth

Calculation Methodology:

The implementation uses the industry-standard Newton-Raphson method for root finding, providing:

- Quadratic convergence rate

- High numerical accuracy

- Efficient computation

- Robust error handling

Security Considerations:

- No data leaves the client

- No server-side processing

- Complete client-side execution

- No tracking or analytics

This XIRR Calculator provides institutional-grade financial analysis capabilities in an accessible web interface, democratizing sophisticated performance measurement tools for both professional and individual users. By combining mathematical rigor with user-centric design, it serves as an essential tool for anyone serious about understanding their investment returns.